PORTFOLIO

Our Strategic Approach

The NQHero Portfolio is a diversified, multi-algorithmic trading system designed to operate across Stock Indexes, Metals, and Currency Futures, with a primary focus on the Nasdaq. It consists of seven distinct algorithms running simultaneously on different symbols and in different asset classes, each engineered to capture different market behaviors. These include trend-following, momentum, breakout, mean reversion, counter-trend, and range-bound intra-day strategies—all strategically weighted and balanced to enhance overall portfolio performance and resilience.

Each strategy is tailored to the unique characteristics of its respective market, with customized inputs, stop losses, and profit targets optimized per asset. The system is built to adapt to evolving market conditions while maintaining disciplined risk management.

Performance is evaluated not only at the individual strategy level but also from a portfolio-wide perspective. Key decision criteria include:

Drawdown (strategy and portfolio level)

Risk-to-reward ratio & Sharpe ratio

Win/loss ratio & Percent profitability

Average trade metrics & Trade frequency

Periodical earnings & Consistency of equity curve.

This holistic, performance-driven and risk-mitigating approach ensures each component contributes to a robust and strategically aligned trading ecosystem.

Our Foundational Principles

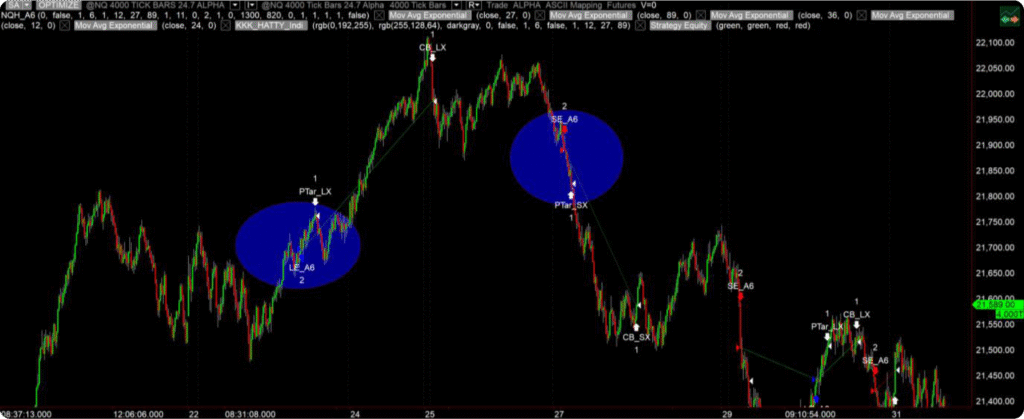

Breakouts

A Breakout occurs when price movement indicates a strong sense of direction, usually attempting to make a new high or low. This strategy is programmed with defined entry and exit criteria, including a custom built -in indicator, conditional sequence patterns, volume, and momentum.

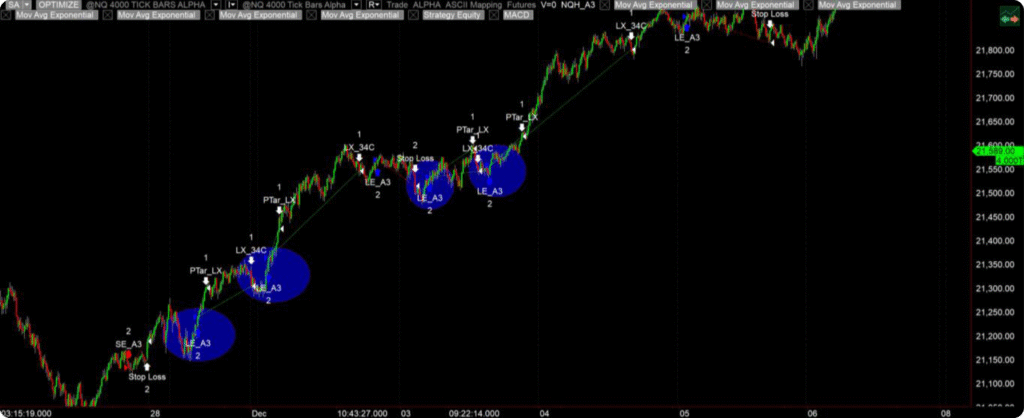

Trend Following

This strategy is designed to identify when a trend might be established, wait for a pullback to enter the market in the direction of the trend, and then use that trend to find more quality trade opportunities. It identifies overbought/oversold levels and patiently waits for the trend to continue.

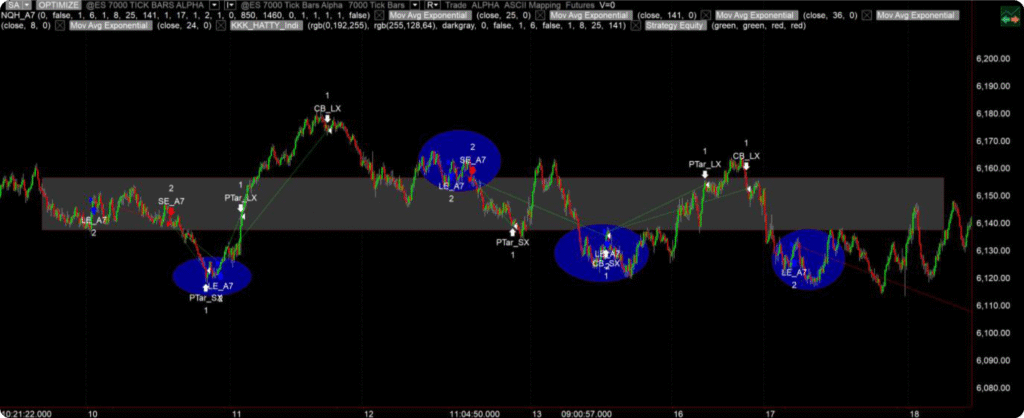

Ranges

This strategy comprises dynamic elements, finding the range’s highs and lows and playing the swings back to the center and even the top/bottom of the sideways market. It can play the ranges and directional moves in which price development and momentum can be exploited.

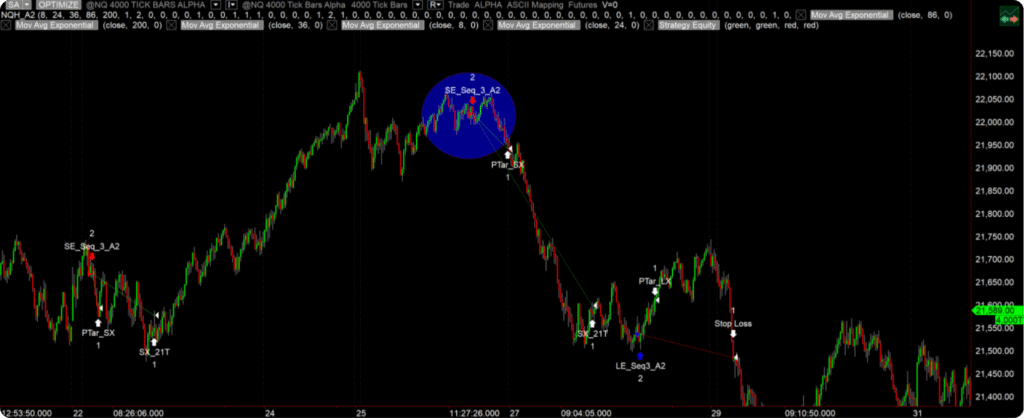

Reversions and Reversals

This strategy is designed to identify tops and bottoms, trade the market back to the mean, and often hold on to that trade if the market reverses entirely. It includes multiple conditional pattern sequence setups, finely tuned profit targets, and dynamic exits.

Our Forward Testing Performance

Year

NQ Hero

Nasdaq 100

S&P 500

YTD

49%

-16%

-10.5%

2024

150%

29%

23%

2023

160%

55%

26%

2022

80%

-33%

-18%

$1M

Account Size

39K

# Total Trades

$4.3M

Total Profit Since June 2022

60%

Win Rate

12%

Average Monthly ROI

1.22

Profit Factor

-11%

Max Drawdown

5.18

Annualized Sharpe Ratio

Live Fundraising Progress

diversification

Consistent Outcomes

Service Description

Diversification Is the Engine of Resilience in NQHero

In trading, diversification isn’t just a risk-management principle—it’s a performance strategy. At NQHero, we embrace diversification at every level of the system to create a more balanced, adaptive, and durable portfolio.

1. Strategy-Level Diversification

Markets behave differently across timeframes and conditions—sometimes they trend, sometimes they chop, sometimes they reverse sharply. No single strategy can perform well in all environments.

That’s why NQHero runs seven distinct algorithms simultaneously, including:

Trend-following & momentum systems

Mean reversion & counter-trend strategies

Breakout systems

Range-bound logic for sideways markets

Each is designed to exploit a specific type of market behavior. This mix allows the system to capitalize on diverse opportunities while smoothing out volatility and reducing overreliance on any one method.

2. Symbol-Level Diversification

NQHero doesn’t just diversify across assets—it diversifies within them. Multiple strategies are deployed on each symbol, allowing for deeper coverage and adaptability in any market condition.

For example:

NQ (Nasdaq) – 6 strategies, ES (S&P 500) – 5 strategies, RTY (Russell) – 3 strategies

YM (Dow Jones) – 3 strategies, GC (Gold) – 5 strategies, SI (Silver) – 3 strategies

CD / BP (Canadian Dollar / British Pound) – 2 strategies each

This intra-symbol diversification ensures that each market is traded from multiple perspectives—trend, mean reversion, breakout, range—maximizing the opportunity to capture favorable setups while minimizing drawdowns from isolated market behaviors.

By diversifying within symbols, NQHero adds another layer of resilience and adaptability to the system, helping sustain consistent performance even when specific strategies or sectors underperform.

3. Asset-Level Diversification

The NQHero portfolio actively trades a range of Stock Index, Metals, and Currency Futures. While these markets can show periods of correlation, they also respond differently to global events, news, and cycles. Diversifying across these assets spreads risk and increases the probability of capturing profitable moves regardless of where the action is.

For example, while equity indexes might stall or range, metals or currency pairs could be trending strongly—creating a constant rotation of opportunity.

4. Portfolio-Level Diversification

At the highest level, NQHero is structured to ensure that all components—strategies, assets, and trade frequency—are intelligently weighted and balanced. This means no single trade, market, or approach can disproportionately impact the entire portfolio.

By aggregating uncorrelated systems and instruments, we’re able to:

Reduce volatility

Improve equity curve stability

Increase consistency over time

Maintain exposure to opportunity while minimizing risk

Why It Matters

Diversification helps ensure that you’re not betting everything on one idea, one direction, or one market condition. It’s what allows NQHero to keep trading through changing environments—staying active, adaptive, and strategically aligned at all times.

It’s not just protection—it’s performance through resilience.

preferred share options

Choose your desired share class

25k

ClASS 'A' SHARES

- 15% Preferred Rate.

- 60/40 Profit Split.

- Monthly Payout net trading costs.

- No Performance fee until deficits are recovered.

- 40% Annual Net Targeted Return.

50k

CLASS 'B' SHARES

- 20% Preferred Rate.

- 70/30 Profit Split.

- Monthly Payout net trading costs.

- profits not taken until deficits are recovered.

- 50% Annual Net Targeted Return.

100k

CLASS 'C' SHARES

- 30% Preferred Rate.

- 80/20 Profit Split.

- Monthly Payout net trading costs.

- profits not taken until deficits are recovered.

- 60% Annual Net Targeted Return.

Book a consult

Use the Form below to initiate a free consultation to see if NQHero’s Automated Trading System is right for you